The Tax Shelter is an efficient and transparent tax measure designed by the Belgian federal government to stimulate the production of audiovisual works in Belgium. The measure is open to Belgian productions as well as eligible European and international co-productions with Belgium.

Type of Projects

European audiovisual works co-produced with Belgium, such as animation, documentary and fiction features, medium-length and short films qualify for the system, as well as animation and live-action series, telefilms and TV documentaries. These can be intended for cinema exhibition or television and multimedia (VR, web series, documentary web) broadcasting (or screening) with the aim of being shown to a wide audience. They must also be certified as a European work, as defined in the Audiovisual Media Services Directive (2010/13/EU).

International audiovisual works co-produced with Belgium, in the following categories: feature film, documentary or animation film intended for a wide audience, provided that :

- they either fall within the scope of the Audiovisual Media Services Directive (2010/13/EU)

- or they fall within the scope of a bilateral co-production agreement concluded by Belgium (or one of the country’s Communities) with another state.

How does it work?

Unlike many other incentive systems within Europe, the Tax Shelter is not a cash or tax rebate expressed as a fixed percentage.

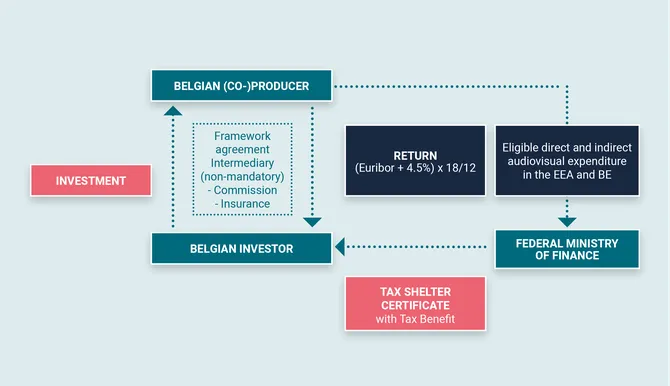

The Tax Shelter is a mechanism whereby certified Belgian (co-)producers can attract Belgian investors to invest part of their taxable profits in an eligible audiovisual work. In exchange for their investment, the investors obtain Tax Shelter certificates from the Federal Ministry of Finances to which a tax benefit is attached. Investors also receive a return on investment in the form of interest on the deposited sums. This interest is calculated according to the average 12-month Euribor rate, increased by 450 basis points, over a maximum period of 18 months. Investors do not acquire any rights in the audiovisual work in which they invest. The share financed with these funds is part of the share of the producer who provides this Tax Shelter financing.

The basis for calculating the Tax Shelter benefit and the investment are the eligible direct and indirect audiovisual expenses that the audiovisual work will spend in the European Economic Area (EEA) and in Belgium. The two elements are inextricably linked. Against each investment there is a tax benefit for the investor and a spending obligation of eligible audiovisual expenditure for the Belgian (co-)producer.

Investors are obliged to pay their entire investment within three months of the conclusion of the Tax Shelter framework agreement. By doing so, investors pre-finance part of the production and/or post-production costs through the purchase of the certificate that offers them a temporary tax exemption. For its part, the Belgian (co-)producer must make the eligible expenses within 18 months (24 months for animation) of signing the framework agreement.

Certified producers can approach investors directly to invest through the Tax Shelter. Alternatively, the Belgian (co-)producer works with an intermediary certified by the Federal Ministry of Finances. This intermediary matches potential investors with projects and draws up the framework agreements. In exchange for these services, a commission is charged to the producer. Several banks also offer this investment opportunity to their customers through an intermediary.

The net amount that can be used to finance the audiovisual work is determined by several variables, including the Euribor interest rate, the commission that the intermediary settles with the producer and the insurance taken out. Taking these variables into account, it can be said that producers can finance between 38% and 40% of eligible Belgian expenditure through the Tax Shelter mechanism. A detailed calculation can be found below in the brochure published by the Federal Ministry of Finances.

Win-win-win

The Tax Shelter system is a win-win-win situation for the three parties involved: producers are offered an attractive framework for the financing and cash-flow of their audiovisual projects; investors receive a tax exemption via a virtually risk-free investment; and the Belgian state benefits from increased economic activity.

Funding through the Tax Shelter can easily be combined with other funds such as Screen Flanders and the Flanders Audiovisual Fund (VAF).

Contacts

Federal Public Service Finance International Investments Department